Legacy Giving

Create a heritage of faith for future generations.

Many friends who share our vision understand that wise biblical stewardship extends to future generations. Through thoughtful, long-range planning, you can ensure your impact on the disciples of tomorrow while achieving your personal financial goals today. You may desire to provide for your family in the future, secure additional income now, or avoid estate and gift taxes. Ligonier can help you accomplish these goals while creating a spiritual legacy that will impact the kingdom of God for decades to come.

To create a heritage of faith, you may wish to consider:

- Remembering Ligonier Ministries in your will or trust.

- Supporting Ligonier in the future at greater levels than possible at present through your retirement plans.

- Naming Ligonier as the sole or partial beneficiary of your bank or investment account or your life insurance.

- Using strategies that offer income for life as well as potential tax benefits.

Ligonier Ministries partners with Barnabas Foundation to serve our friends in the area of biblical stewardship. Together we can help you explore tax-wise charitable arrangements to achieve your personal, financial, and spiritual goals.

For more information, please contact our gift planning officer by emailing stewardship@ligonier.org or by phoning 800-220-7636. You may also contact Barnabas Foundation directly at 888-448-3040 to learn more about various gift planning opportunities.

We recommend that you consult your professional advisor regarding current tax law and to determine which charitable gifts are appropriate for you. We do not render tax or legal advice for any purpose. Ligonier Ministries is registered as a 501(c)(3) non-profit organization with the Internal Revenue Service.

Remember Ligonier in Your Will or Trust

Wise stewardship requires that we adequately prepare for the future. We at Ligonier are diligently planning for the continuation of our ministry as we strive to see sound biblical teaching prevail in the church, under the Lord’s blessing, for generations to come. Through a bequest in your will or trust, your partnership can help establish this vital work for future generations. We trust that such thoughtful planning will be used by God to awaken the next generation to His holiness and will serve as a bold Christian witness to those who learn of your intention to support our work through your estate plans.

Creating a will is not difficult or expensive and can be deeply rewarding. If you fail to prepare or update your will, state law determines how your assets will be divided using a formula that may not represent your wishes. Only through careful estate planning can you guarantee that your property will pass to the people and organizations that are meaningful to you.

As you work with your professional advisor, it will be helpful to note:

- Ligonier Ministries operates as a non-profit organization under the laws of the State of Florida using the following tax identification number: EIN# 25-1298611. We are qualified for tax exemption under section 501(c)(3) of the IRS code. That means that your legacy gift to us removes assets from the taxable portion of your estate.

- Your bequest can be a stated dollar amount, a percentage, a specific asset, or the remainder of your estate after other distributions have been made.

- Sample bequest language to be used in your will or trust:

I give the sum of % of my estate to Ligonier Ministries, Attn: Ministry Advancement Dept. 421 Ligonier Court, Sanford, FL 32771, to be used to proclaim the holiness of God in all its fullness to as many people as possible.

If you have remembered Ligonier in your estate plans, please let us know. We want to acknowledge your desire to establish a spiritual legacy that will continue to advance the kingdom of God. If you have not considered this option, why not join with other friends who have made “the ultimate gift”? Through a bequest, you will maintain your support of gospel outreach, perhaps at greater levels than possible at present. We are deeply grateful for such forethought and the impact of such faithfulness to Ligonier’s mission.

For more information about including Ligonier in your will or trust, or for other tax-wise giving opportunities, please contact our gift planning officer by emailing stewardship@ligonier.org or by calling 800-220-7636.

You may prefer to contact Barnabas Foundation directly for a complimentary consultation with a Christian estate attorney by calling 888-448-3040.

Make Legacy Gifts through Your Retirement Plans

The need to plan and save for retirement may mean that your retirement accounts have become your most significant assets. Yet there is a downside to such accumulation of wealth. Required distributions are taxable income to you or your spouse. In addition, your heirs may find themselves paying considerable taxes on those funds if inherited during their peak earning years. Combined with estate and other taxes, that can result in a substantial tax impact on the retirement funds you diligently saved and invested. For that reason, your IRA, 401(k), or other qualified retirement plan may present an attractive way to support Ligonier Ministries in the future at greater levels than possible at present.

By designating Ligonier as the beneficiary of a retirement account, you ensure that:

- The gift becomes deductible for estate tax purposes.

- Your heirs will receive assets that are not as highly taxed.

- Your gift will have maximum impact. Ligonier’s charitable tax-exempt status means we are not required to pay taxes on assets that are donated.

- By God’s grace, the kingdom of God will continue to benefit from the full value of your thoughtful gift planning for generations to come.

If you have questions about making a legacy gift to Ligonier through your retirement plan or in another way, please contact our gift planning officer by emailing stewardship@ligonier.org or by calling 800-220-7636.

Naming Ligonier the Beneficiary of a Bank or Investment Account

One of the simplest ways to make a legacy gift to Ligonier Ministries is by naming us as a direct beneficiary of your bank or investment accounts. These accounts include checking, savings, certificates of deposit, or brokerage accounts holding stocks, bonds, or mutual funds. Such gifts are made apart from a will or trust. This means that they do not require the services of an attorney to execute and will be transacted speedily, in accordance with your wishes.

Your bank or financial institution can provide you with a simple form on which you can direct a dollar amount, percentage, or the entirety of a specific account to Ligonier. In order for us to receive the proceeds, the only requirement is that a death certificate be provided to the financial service institution. The intended funds will be sent to us quickly, as this type of provision does not need to pass through probate court and will not be held up as estate assets are inventoried or sold.

It is important to note that these arrangements take precedence over your will or trust. In other words, the beneficiaries named to receive your account in the future are the first to receive assets, which may affect what other heirs receive who are named in your estate plan documents. Therefore, you should carefully consider this option and remember the provisions you have made to account beneficiaries when you update or change your estate plans over time. Someone you trust should be informed about these intentions so that they can make notifications when the time comes. For an individual who has few or no heirs, this could be an attractive, simple, and inexpensive way to make a legacy gift.

To name Ligonier as the beneficiary of one of your bank or brokerage accounts, please secure the appropriate form from the institution and identify us as:

Ligonier Ministries

421 Ligonier Court

Sanford, FL 32771

EIN# 25-1298611

For more information about this or other ways of creating a spiritual heritage by continuing to support Ligonier’s outreaches, please contact our gift planning officer by emailing stewardship@ligonier.org or calling 800-220-7636.

Giving Through Life Insurance

There are several unique advantages to making a charitable donation through a life insurance policy. Such a legacy gift is simple to arrange and does not require the services of an attorney or related legal costs. Also, the size of the gift is assured in advance and will not depend on the fluctuations of the market or other economic factors.

Making a charitable gift by designating Ligonier as the beneficiary of a life insurance policy may be particularly appealing to those concerned with preserving other assets for family members. Since the donation is made outside of your will or trust, it guarantees that your wishes will be carried out swiftly and as intended. By making gifts through smaller annual premium payments, you assure a sizable gift to our mission that does not impact your holdings.

Some options include:

- Making Ligonier the beneficiary of the life insurance policy offered at your place of employment.

- Contributing an obsolete policy that can benefit the kingdom now.

- Establishing a new policy for which you gift premiums to Ligonier that are deductible as charitable donations for tax purposes. Ligonier in turn uses those funds to pay the premiums on a life insurance policy that has named our ministry as the beneficiary.

Please contact our gift planning officer by emailing stewardship@ligonier.org or by calling 800-220-7636 ext. 1185 to discuss this attractive opportunity. You can help proclaim the truth of Scripture and Reformed theology to the generations that follow.

Gifts That Provide Income and Tax Benefits

In partnership with Barnabas Foundation, Ligonier is pleased to offer a giving opportunity that can increase your income and provide significant tax benefits while securing future support for our vital outreaches.

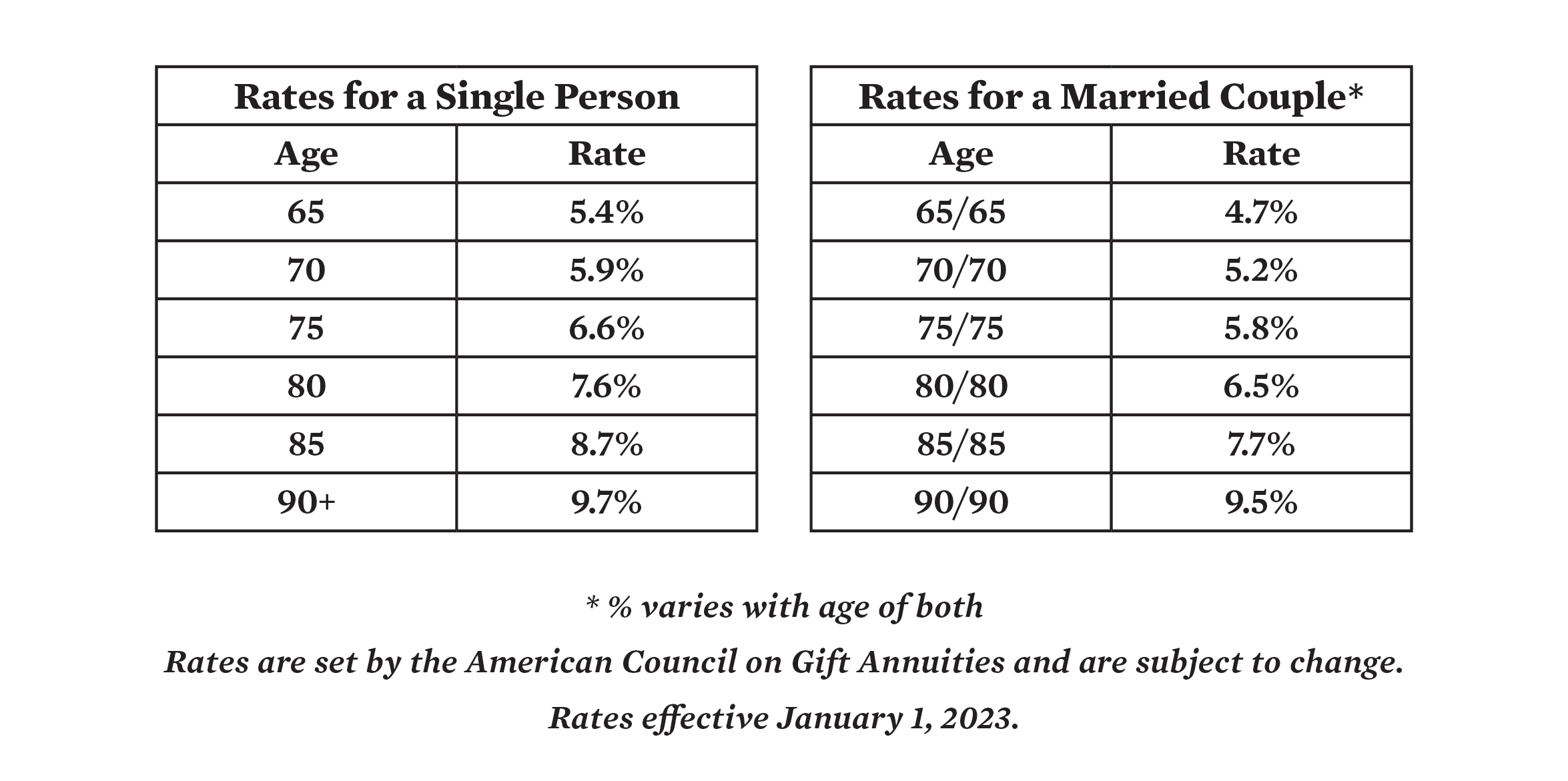

Through a Charitable Gift Annuity, you make a gift that pays you an income for life or the lives of you and your spouse. The rate of return is based on your age at the time of your gift and will never change, no matter the fluctuations of the markets or economy. Here are some sample rates.

When you establish a Charitable Gift Annuity in exchange for a donation of cash or securities, you not only receive income for life, but you will typically receive a significant charitable tax deduction for a portion of the gift. In addition, a part of your annual payout will be tax-free. After your lifetime, the remainder of the gift will go to Ligonier Ministries to proclaim God’s truth and advance the gospel.

If you are dissatisfied with present returns on fixed income investments or have appreciated stock that you hesitate to cash in because of the taxes you will owe, a Charitable Gift Annuity may be the solution for you. It provides:

- Increased income for life.

- A substantial charitable tax deduction.

- Annual payments that are partially tax-free.

- The satisfaction of knowing you will leave a legacy of faith.

Contact our gift planning officer by emailing stewardship@ligonier.org or by calling 800-220-7636 ext. 1185 for more details. We will be happy to provide you with additional information and confidential illustrations of how a Charitable Gift Annuity might benefit you.

Legacy Giving

Create a heritage of faith for future generations.

How may we help?

Our team would be happy to answer any questions you may have about our outreach or the ways you can help further the mission. Please contact us using the chat bubble, email, or calling 800-435-4343.